Seizing the Seafloor: Examining the U.S.’s Deep-Sea Minerals Policy and Strategy since the Executive Order 14285; Unleashing America’s Offshore Critical Minerals and Resources

December 02, 2025 - Written by Isabella Oedekoven Pomponi

Introduction

The implementation of Executive Order 14285:‘Unleashing America’s Offshore Critical Minerals and Resources’, officially administered by President Trump on April 24th, 2025, focuses the second Trump administration’s efforts on deep-sea mining (DSM) as a core aspect of its critical minerals policy. The order explicitly designates the minerals found on the seabed and the technology needed to retrieve them, as central to U.S. ‘core national security and economic interests’, and seeks to strengthen the state’s position in the face of China’s critical mineral industry dominance.

Executive Order 14285 introduces key areas of policy:

Streamlining the application and permitting processes to increase domestic DSM capabilities under the reactivation of the 1980 Deep Seabed Hard Mineral Resources Act (DSHMRA).

Increasing investments in DSM mapping, science, and technology.

Coordinate efforts between key agencies for science, mapping, and technological developments.

Creating a secure supply chain connecting offshore mineral concentrations to domestic growth, industry, and military readiness - by decreasing foreign dependence on mineral sourcing and increasing domestic harvesting and processing capacity.

Establishing the U.S. as a global leader in responsible mineral sourcing, practices, and technologies.

Strengthen international alliances through cooperation to counter China’s dominant position over critical mineral sourcing and growing influence over deep-sea concentrations.

Within 60 days, the Secretary of Commerce, through consultation with other relevant agencies, must provide a report identifying which seabed minerals are critical for defence and energy, and to expedite their permitting processes.

The order defines the geographic areas of the U.S.’s Exclusive Economic Zones (EEZs) to be of DSM interest and, controversially, references its policy application to beyond national jurisdiction and into international waters.

Offshore critical mineral concentrations are higher compared to terrestrial concentrations, and DSM activity presents as a lucrative industry for their acquisition. Key mineral deposits contain cobalt, nickel, copper, and manganese concentrates found within polymetallic nodules, cobalt-rich crusts, and seamounts.

The executive order aims to strategically boost the U.S.’s position in the critical mineral supply chain by encouraging partnerships with the American private sector to counter China’s current controlling stake in critical mineral sourcing, refinement, and processing. Long-term goals of the order include reducing foreign dependency on mineral sourcing, strengthening domestic industry sovereignty, and increasing key strategic reserves to mitigate potential market and mineral availability disruptions.

Background Information on Critical Minerals

Critical Minerals & Energy Geopolitics

Market demand for critical minerals is growing significantly- largely due to the green-energy transition - with companies and governments looking to meet rising sourcing demand. Cobalt, in particular, has high demand as it is essential for batteries, green energy technologies, and defence applications. Investments in sourcing and individual mineral demand have grown, indicating significant public and private sector shift and growth within the critical mineral industry. This growth has sparked a significant geopolitical trend, where states and industry shareholders are wanting to diversify and secure minerals needed for industry growth.

China currently holds a dominant position over global influence and market share on sourcing, refinement and export of critical minerals. Roughly 80% of the world’s cobalt is sourced from the Democratic Republic of Congo (DRC), of which 80% is sourced by Chinese firms. Chinese exports account for roughly 60-90% of the global supply of refined cobalt, of which 67.5% is sourced from the DRC.

Executive Order 14285 seeks to counter China’s dominant position by strengthening the U.S.’s posture and capabilities as a critical minerals industry and geopolitical competitor.

Terrestrial Mining: Case of The Democratic Republic of Congo (DRC)

The DRC’s cobalt history began during Belgian colonialism with Belgian mining companies extracting the mineral for WW1 aerial technologies. The 1960s saw the nationalisation of mining rights, and an associated reduction in private ownership stakes in the mining concessions (minable land grants). However, perpetual conflict over resource control spanning the next 40 years weakened state sovereignty, reducing regulatory and protectionary capacity. To increase state capacity and fund internal development initiatives, former DRC President Joseph Kabila introduced the 2002 Mining Code, which established mining industry regulation and structured revenue collection. Private foreign entity mining contracts were renegotiated for larger state positions for tax collection. This risk of asset nationalisation, coupled with an unstable political landscape, led to the Western withdrawal of their terrestrial mining investments.

To fill the mining gap, President Kabila turned to China, who sought to supply its then-budding battery manufacturing industry with raw minerals through its Going Out strategy. Subsequently, the Sino-Congolais des Mines (SICOMINES) agreement was signed in 2007. A resources-for-infrastructure agreement, Chinese firms pledged $4 billion into infrastructure projects in exchange for rights to mining concessions valued at approximately $93 billion.

Controversy still surrounds the DRC’s terrestrial mining industry. The industry has faced criticism for decades of severe environmental damage from largely unregulated mining practices, community displacement, and allegations of human rights abuses, and illegal and high-risk mining practices. Such concerns have prompted suggestions that DSM may be an alternative for cobalt sourcing.

History of Deep Sea Mining

Critical minerals are found in key offshore deposits, usually geographic areas of historic or recent volcanic activity, and most commonly concentrated within polymetallic nodules, cobalt-rich crusts.

The Clarion-Clipperton Zone (CCZ) contains the highest known oceanic concentration and quantities of critical minerals and is located between Hawaii and Mexico. An area of 4.5 million km2 (1.7 million mi2) situated between Mexico and Hawaii, it is estimated to contain 100 million tonnes of nodules. Interest in DSM is not a new phenomenon; the 1970s-80s marked a nodule rush era, which eventually subsided.

Between 1972 and 1982, nodule extraction research was fuelled by fervour and excitement, but the emergent industry’s fate was in part determined by the then-coinciding third UNCLOS (UN Convention on the Law of the Sea) talks. UNCLOS III established the International Seabed Authority (ISA) in 1982, and granted governance authority over all activity on the seabed beyond national jurisdiction (referred to as, “the Area”), including the drafting of legislation on exploration and exploitation regulations. Disagreeing with the provisional outcomes prior to the treaty’s finalisation led to the U.S. not ratifying the agreement and passing DSHMRA instead to preserve its industry autonomy.

Commercial DSM interest and diplomatic efforts regarding DSM regulation waned in part due to both disagreements on whether or how resources found in international waters should be shared, and the reveal of a Cold-War conspiracy. A major DSM industry leader had utilised market fervour as a cover to recover a sunken soviet submarine near the CCZ for the U.S. during the Cold War on a supposed DSM exploration endeavour.

Map of Critical Mineral Deposits

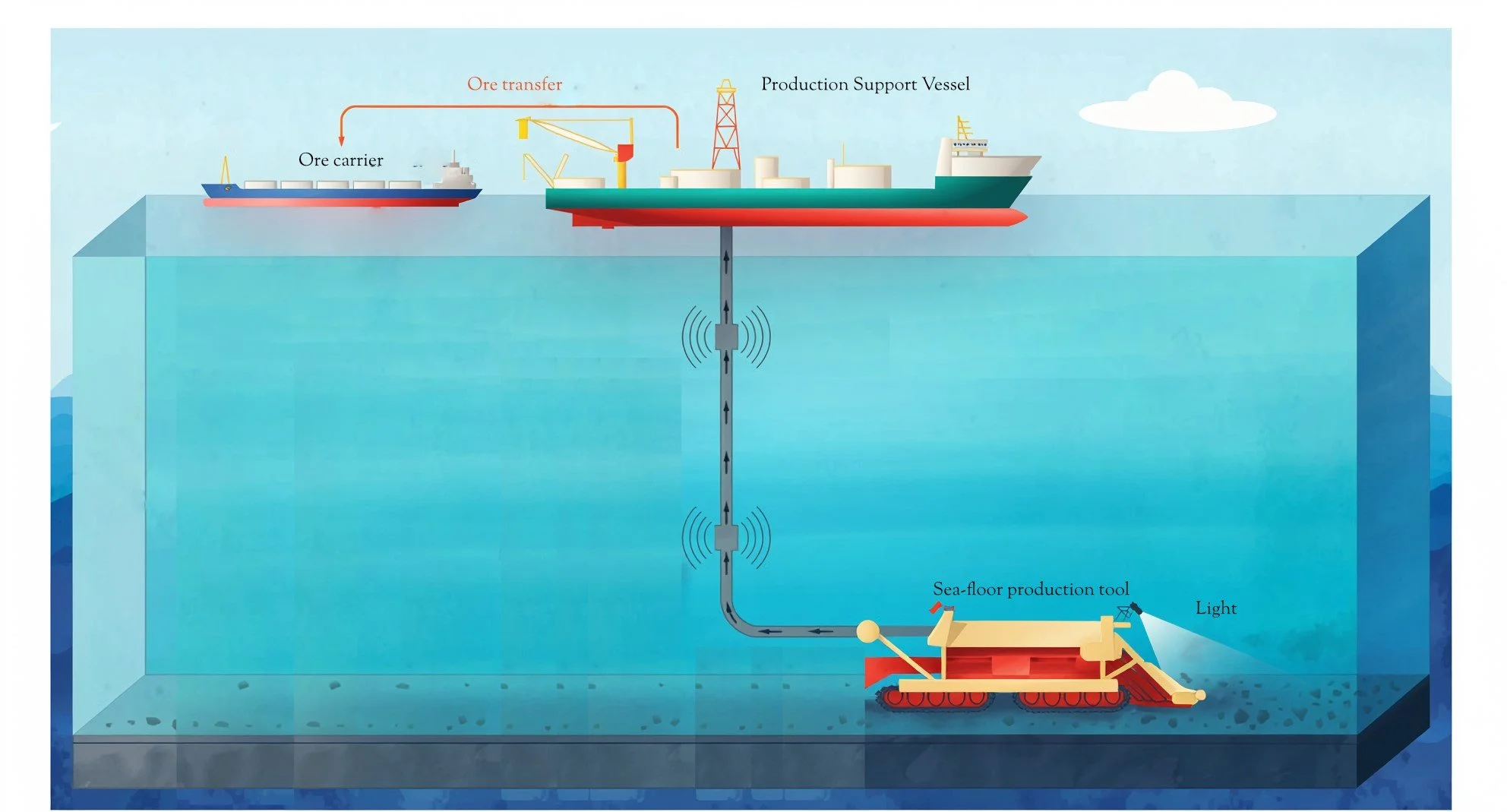

Deep Sea Mining Operations Equipment.

Executive Order 14285: Unleashing America’s Offshore Critical Minerals and Resources

The order revives the 1980s-era legislation DSHMRA, which authorised DSM activity for U.S. entities, including private enterprises. Though the U.S. had not ratified UNCLOS and was not a full member ISA, the legislation authorised DSM activity in international waters under U.S. foreign relations law.

Notably, DSHMRA granted DSM permitting issuing power to the National Oceanic and Atmospheric Association’s (NOAA) purview, the process which the executive order has now called for to be expedited. The DSHMRA framework explicitly outlines the permits to be issued to U.S. citizens and entities, which the Executive Order reinforces by linking the acquisition of critical minerals to national security.

Renewed Industry Interest in DSM

After Executive Order 14285’s issuance, industry and commercial reaction has been swift, signaling support and interest from private mining and defence entities to enter into the highly speculative industry.

Just five days after Executive Order 14285 was issued, the U.S.-subsidiary of the Canadian mining company, The Metals Company (TMC USA, “TMC”), applied for two exploration licenses and one commercial recovery permit under DSHMRA for the CCZ. TMC’s issued statement argued that the support from Washington, the regulatory framework for operations, and decades of DSM and environmental research would allow for its proposed commercial activity to be successful.

TMC’s commercial recovery application sparked vertical industry interest with Korea Zinc, the world’s largest zinc smelter, buying a 5% stake in TMC in June 2025. The move reflects the company’s prediction of an increase in material to be processed, and signals support for the Trump administration’s policy shift.

In July 2025, Lockheed Martin announced that its 1980s legacy DSM licenses for the CCZ issued under DSHMRA were receiving renewed interest from mining companies seeking to partner for access. Lockheed Martin’s CEO noted that the company is now working closely with the Pentagon to identify and secure resources for stockpiling strategies.

Renewed calls for a DSM moratorium

Though receiving industry support, the U.S administration’s policy shift has received pushback from multilateral organisations, environmental rights and protection groups, as well as market skeptics due to its still speculative presence.

On April 30th, the ISA released a statement criticising Executive Order 14285, stating the policy shift bypasses multilateral governance frameworks and poses a significant risk to vulnerable ecosystems. In late July, the ISA’s 30th session convened, reaffirming its position that U.S.-authorised DSM activity would cause adverse harm to marine life and vulnerable ecosystems and disrupt progressing multilateral negotiations for DSM regulations. Currently, 40 states support an immediate DSM moratorium.

Global environmental groups have condemned the move, raising concern over the still-unknown scale of environmental impact on the vulnerable and unique seabed ecosystems. A highly referenced nodule-rush era seabed disruption experiment (The DISCOL experiment), yielded results that disturbance and impact to seabed environments were long-term, but conceded that its methods did not reflect DSM activity accurately. Other environmental impacts include sediment clouds that harm marine life

Financial investigative firm Iceberg Research published a report impacting the emergent industry, making their case that TMC’s financial outlook overvalued its commercial viability and overestimated nodule yield profitability. The report highlighted similarities between TMC’s effort to the now-bankrupted Nautilus Minerals endeavor in Papua New Guinea (PNG). Similar to Nautilus in PNG, TMC does not currently have a signed pre-feasibility study (PFS), a document that estimates economically viable reserves, for the CCZ zone it intends to mine. Additionally, the report noted that TMC’s preliminary nodule collections in 2022 yielded lower-than-estimated counts, as well as mineral price fluctuations that accelerated operational costs unsustainably. Iceberg projects that TMC is likely to suffer a similar fate to Nautilus.

Risks and Opportunities

Opportunities

U.S.-encouraged DSM activity could provide market relief for critical mineral supply shortages and price stabilisation in the face of stalled ISA regulatory obligations

The ISA, responsible for the negotiation of DSM regulations in international waters, has faced criticism in its historic record of failing to provide regulatory updates and legislation pertaining to DSM activity. In 2021, Nauru submitted an application for DSM activity, triggering a two-year deadline for the organisation to elaborate on regulations, which the ISA failed to meet. Under its own framework, if the deadline is not met, then speculative applications are considered approved. The most recent ISA session advanced negotiations, but failed to deliver finalised legislation among environmental concerns and economic interests.

These historic delays in negotiations prevented TMC from obtaining licenses through the ISA, despite strong interest, and led the company to capitalise on the Trump administration’s policy shift to seek an alternative pathway.

DSM could provide a strategic avenue for the U.S. to decrease its reliance on Chinese-processed material

A U.S. Geological survey estimated that the U.S. had a 70% reliance on China for all critical mineral imports. The U.S. defence and technology industries are at increased risk of sudden availability shocks and price volatility, as they rely on ‘heavier’ critical minerals for costlier defence applications. Some key applications include missiles, F-35 jets, unmanned aerial vehicles (UAVs, also “drones”), batteries, and computer chips.

Divesting from Chinese-dominated supply chains would likely require a lengthy and expensive process. Processing raw materials is expensive, requiring large initial investments into processing facilities, and is extremely polluting. Incorrect waste management can cause extensive, human and environmental harm. Additionally, a regulatory-compliant supply-chain would need to be established and audited to adhere to the Executive Order’s mandate on promoting the industry in an environmentally sustainable and responsible manner. However, companies, including Korea Zinc, foresee a positive outcome regarding these necessary developments.

Risks

It is likely that the Executive Order will face legal and regulatory challenges, as DSM activity authorised under U.S. law contends with UNCLOS although the U.S. is not a signatory party

The CSIS published a review noting that while DSHMRA was passed before the finalisation of UNCLOS III, any mining activity authorised exclusively under U.S. law would counter UNCLOS and ISA authority directly and severely disrupt multilateral high-seas mining precedent. The Common Heritage of Mankind principle prevents any single state from claiming a resource found in international waters as solely its own. A contentious legal battle is likely to occur over licensing authority if TMC begins operating under a U.S. license in an area the ISA governs.

If the U.S. successfully bypasses the ISA, CSIS stresses that it could likely incentivise other states to follow suit, opening the possibility of future mining territory claim conflicts and increased difficulties in regulating the industry.

The DSM industry has historically faced, and likely will continue to face, high levels of public and environmental organisational disapproval and challenges. Already, 40 states support a moratorium on DSM activity, citing environmental impact concerns. The State of Hawaii has passed legislation banning the activity within state waters after public pressures. Without a clear operational and regulatory framework to operate within, DSM activity could be costly in operational expenses and environmental damages.

The battleground of a Great-Power competition

The U.S.’s actions in promoting its own DSM agenda in international waters could have further-reaching geopolitical consequences than initially predicted. The involvement of defence‑industry actors and high‑stakes exploration/permit filings indicates the seabed‑minerals industry is entering a new phase of competition—both commercial and geopolitical—with Chinese influence as the U.S. 's counterpart.

A driver among divestment arguments are fears that China could strategically halt mineral exports to the U.S., crippling key strategic industries. Ongoing trade contentions recently escalated with China temporarily suspending exports of several critical minerals and leveraging its dominant position in ongoing trade discussions with Washington. Already, China has tightened export controls on processed minerals since October 2025, requiring foreign companies to obtain export licenses for goods containing Chinese-processed critical mineral components.

Implications for broader geopolitics

In May 2025, Chinese mining research companies successfully obtained approval from the ISA to begin planning a collection trial in an area of the Pacific, east of Japan’s continental shelf. The companies noted, it was the first of the Chinese applications’ environmental impact reports that met the strict ISA standards. Historically, China has adhered to the Common Heritage principle and has not conducted mining activity in international waters, but analysts suggest that the U.S.’s efforts to bypass multilateral frameworks would embolden similar behaviour from China. Critically, CSIS points out that China’s position in challenging UNCLOS in regards to its ongoing South China Sea dispute could significantly strengthen if the U.S. similarly challenges and bypasses ISA authority over the CCZ.

U.S. divestment, and if China continues to adhere to ISA multilateral guidelines and negotiations, could be seen as a continuation of China seeking to broaden its influence in the multilateral sphere since the Trump administration's shift to promoting an America First policy objective which has reduced its overall global presence. It would also likely significantly weaken the U.S.’s position in the current multilateral rules-based governance structure, reducing its global influence if it is perceived as an unpredictable or rogue actor.

Policy Recommendation

Focusing on investing in DSM activities in the U.S. Exclusive Economic Zones, and through international partnerships could yield lucrative results

By focusing on DSM industry development within the U.S.’s EEZs, the benefit could be multifold; EEZ DSM activity wouldn’t challenge the ISA’s authority, and this focus could be more commercially viable for the U.S. to build own viable long-term supply chain processes from raw material sourcing to processing capacity.

DSM activity in U.S. EEZs would be governed under sole U.S. authority, and would not conflict with the potential overlapping of permitted areas in the CCZ. The Executive Order mandates an expedited examination for viable mineral deposits found within the EEZ, which industry stakeholders with the technologies and capital needed could capitalise on. Regarding TMC, a focus on EEZs would prevent a potential overlap in permitted territory authorised for exploration or mining activity. By avoiding this overlap potential, this move could prevent legal challenges between the ISA and the U.S. under international law, as well as provide opportunity for the continued development of DSM regulation.

This.move would also benefit the U.S. by maintaining its strategic influence over international maritime geopolitics. The U.S. has historically been a staunch upholder of international maritime order, in particular through its Freedom of Navigation program. This U.S. initiative, under Pentagon-authorised international law justification, has allowed for the U.S. to conduct U.S.-Navy sailings to dispute China’s claim over the South China Sea territory. Because China supports its South China Sea territory claims under UNCLOS justification, U.S. defiance over UNCLOS ISA governance jurisdiction in the CCZ would significantly reduce its position in countering China's territorial claims.

Until the 1980s, the U.S. was the largest global processor for rare-earth (also “critical”) minerals, but was overtaken by Chinese competition. Today, only one U.S. rare-earth terrestrial mine remains operational, but still sends its material to China for processing due to cheaper Chinese processing costs and material scale demands. If the U.S. seeks to divest from Chinese reliance for materials sourcing, then increased planning and investment schemes could be developed to build domestic capacity. Alternatively, capacity could be bolstered through agreements with allied states and foreign investment initiatives. Outsourcing this capacity through international partnerships could yield competitive rates for operational and labour costs, and provide additional material for global price and supply stabilisation while achieving policy goals of securing a secure mineral supply. Additional, operation and supply chain costs must be heavily considered when mining areas in remote geographic areas of the ocean.

Conclusion

The DSM industry remains speculative and contentious, but is fueled by increasing industry and market support and fervor. While not yet operational, support from the Trump administration has incentivised movement in the deployment of viable operations, in both the U.S. EEZs and the CCZ. Though challenging decades of international precedent regarding DSM governance, the EO’s mandate has motivated stakeholders to bypass stagnating multilateral regulatory efforts. Though DSM is not yet fully operational, and market skepticism remains, the Trump administration’s policy shift has revealed a significant appetite for the development of a new frontier in the critical minerals industry.

Written by Isabella Oedekoven Pomponi

Analyst on the North America Desk